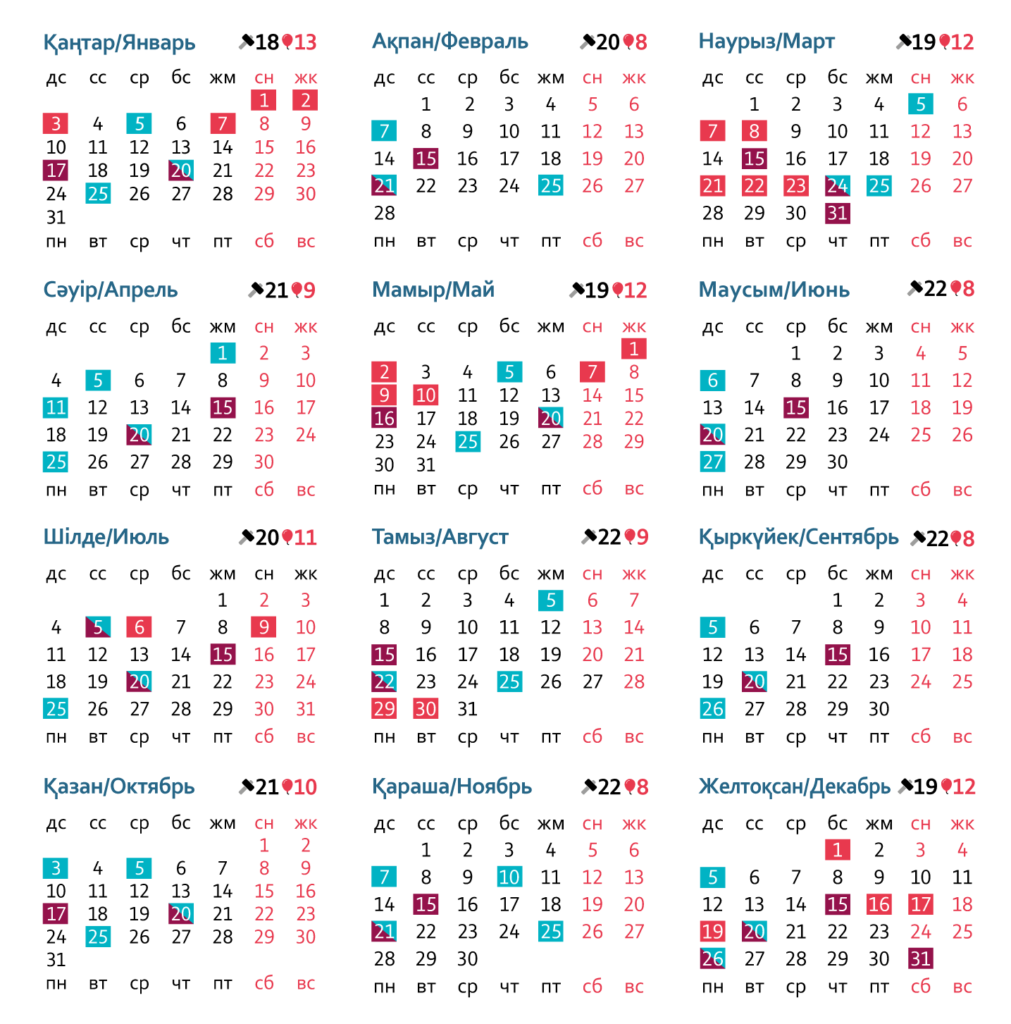

Calendar of taxes and payments 2022

Tax reporting dates and payments to the budget in 2022

5 January

Payments:

— IPN of a person engaged in private practice

January 17

Tax reporting:

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for November 2021

January 20th

Tax reporting:

— form 101.01 – calculation of the amounts of advance payments for CIT before the submission of the CIT declaration for the 1st quarter of 2022

— form 320.00 – declaration on indirect taxes on imported goods + statement on the importation of goods and payment of indirect taxes on form 328.00 for December 2021

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

The 25th of January

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Payment for placement of outdoor (visual) advertising

— CIT at the source of payments

February 7

Payments:

— IPN of a person engaged in private practice

February, 15

Tax reporting:

— form 101.03 — calculation of CIT at the source of payments for the 4th quarter of 2021

— form 200.00 – PIT and social tax declaration for the 4th quarter of 2021

— form 300.00 – VAT return for the 4th quarter of 2021

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for December 2021

— form 570.00 – export tax return for the 4th quarter of 2021

— form 590.00 – mineral extraction tax return for the 4th quarter of 2021

— form 701.01 – calculation of current payments for land tax and property tax for 2022

— Form 710.00 – Gambling tax return and flat tax for the 4th quarter of 2021

— form 860.00 - declaration on payment for the use of surface water resources for the 4th quarter of 2021

— form 870.00 – declaration on payment for emissions into the environment for the 4th quarter of 2021

— form 910.00 – simplified declaration for the 2nd half of 2021

February 21

Tax reporting:

— form 851.00 – calculation of current payments for the use of land plots for 2022

— form 320.00 - declaration on indirect taxes on imported goods + statement on the importation of goods and payment of indirect taxes on the form 328.00 for January 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

25 February

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Rent tax on export

— Mineral extraction tax

— Payment for the use of surface water resources

— CIT at the source of payments

— Value Added Tax (VAT)

— Taxes and payments under the simplified declaration for the 2nd half of 2021

— Payment for placement of outdoor (visual) advertising

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Gambling business tax

— Current payment for emissions into the environment

the 5th of March

Payments:

— IPN of a person engaged in private practice

March 15th

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for January 2022

March 24

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for February 2022

— form 870.00 – declaration on payment for emissions into the environment up to 100 MCI for 2021

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

— Redemption of the limit on payment for emissions into the environment up to 100 MCI

March, 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Payment for the use of radio frequency spectra

— Payment for placement of outdoor (visual) advertising

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

— CIT at the source of payments

March 31

Tax reporting:

— form 100.00, 110.00, 150.00, 180.00 – CIT declaration for 2021

— form 101.04 — calculation of CIT at the source of payments on accrued but unpaid amounts of income of a non-resident for the 4th quarter of 2021

— form 220.00, 240.00 – tax return for 2021

— form 540.00 – excess profit tax return for 2021

— form 700.00 – declaration for land tax, property tax and vehicle tax for 2021

— form 871.00 - register of lease (use) agreements

— Form 912.00 - Declaration under the special tax regime with a fixed deduction for 2021

— form 920.

April 1

Payments:

— Payment of tax on vehicles of individuals for 2021

April 5

Payments:

— IPN of a person engaged in private practice

April 11

Payments:

— Final settlement of IIT / CIT, land tax, property tax, vehicle tax according to the declaration for 2021

— Unified land tax for the period from October 1 to December 31, 2021

— Taxes under the special tax regime with the use of a fixed deduction

— CIT at the source of payments on accrued but unpaid amounts of income of a non-resident for the 4th quarter of 2021

— Tax on excess profits

April 15

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for February 2022

20 April

Tax reporting:

— form 101.02 – calculation of the amounts of advance payments for CIT after the submission of the declaration for the 2-4 quarter of 2022

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for March 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

25th of April

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

5 May

Payments:

— IPN of a person engaged in private practice

16th of May

Tax reporting:

— form 101.03, 101.04 — calculation of CIT at the source of payments for the 1st quarter of 2022

— form 200.00 – PIT and social tax declaration for the 1st quarter of 2022

— form 300.00 – VAT return for the 1st quarter of 2022

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for March 2022

— form 570.00 – export tax return for the 1st quarter of 2022

— form 590.00 – mineral extraction tax return for the 1st quarter of 2022

— form 710.00 – gambling tax return and flat tax for the 1st quarter of 2022

— form 860.00 - declaration on payment for the use of surface water resources for the 1st quarter of 2022

— form 870.00 – declaration on payment for emissions into the environment for the 1st quarter of 2022

May 20

Tax reporting:

— form 320.00 - declaration of indirect taxes on imported goods + application for the importation of goods and payment of indirect taxes on form 328.00 for April 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

May 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Value Added Tax (VAT)

— Rent tax on export

— Mineral extraction tax

— Payment for the use of surface water resources

— Payment for placement of outdoor (visual) advertising

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Current payment of fees for emissions into the environment

— Gambling business tax

— Retail tax under the special tax regime

June 6

Payments:

— IPN of a person engaged in private practice

June 15

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for April 2022

June 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + application for the importation of goods and payment of indirect taxes on form 328.00 for May 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

27th of June

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

— Payment for the use of radio frequency spectra

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

5'th of July

Tax reporting:

— form 701.00 – calculation of current vehicle tax payments for 2022

Payments

— IPN of a person engaged in private practice

— Current vehicle tax payment

July 15

Tax reporting:

— form 250.00 - declaration of assets and liabilities on paper

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for May 2022

July 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for June 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

July 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

5th of August

Payments:

— IPN of a person engaged in private practice

August 15

Tax reporting:

— form 101.03, 101.04 — calculation of CIT at the source of payments for the 2nd quarter of 2022

— form 200.00 – PIT and social tax declaration for the 2nd quarter of 2022

— form 300.00 – VAT return for the 2nd quarter of 2022

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for June 2022

— form 570.00 – export tax return for the 2nd quarter of 2022

— form 590.00 – mineral extraction tax return for the 2nd quarter of 2022

— form 710.00 – gambling tax return and flat tax for the 2nd quarter of 2022

— form 860.00 - declaration on payment for the use of surface water resources for the 2nd quarter of 2022

— form 870.00 – declaration on payment for emissions into the environment for the 2nd quarter of 2022

— form 910.00 - simplified declaration for the 1st half of 2022

August 22

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for July 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

25-th of August

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Taxes on a simplified declaration for the 1st half of 2022

— Value Added Tax (VAT)

— CIT at the source of payments

— Mineral extraction tax

— Rent tax on export

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Payment for placement of outdoor (visual) advertising

— Payment for the use of surface water resources

— Current payment of fees for emissions into the environment

— Gambling business tax

— Retail tax under the special tax regime

September 5

Payments:

— IPN of a person engaged in private practice

September 15th

Tax reporting:

— form 250.00 - declaration of assets and liabilities on paper

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for July 2022

September 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for August 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

September 26

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

— Payment for the use of radio frequency spectra

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

October 3

Payments:

— Payment of the combined tax on the property of individuals

October 5

Payments:

— IPN of a person engaged in private practice

17 October

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for August st 2022

The 20th of October

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for September 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

the 25th of October

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

November 7

Payments:

— IPN of a person engaged in private practice

10th of November

Payments:

— Payment of the unified land tax for the period from January 1 to October 1, 2022

15th of November

Tax reporting:

— form 101.03, 101.04 — calculation of CIT at the source of payments for the 3rd quarter of 2022

— form 200.00 – PIT and social tax declaration for the 3rd quarter of 2022

— form 300.00 – VAT return for the 3rd quarter of 2022

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for September 2022

— form 570.00 – export tax return for the 3rd quarter of 2022

— form 590.00 – mineral extraction tax return for the 3rd quarter of 2022

— form 710.00 – gambling tax return and flat tax for the 3rd quarter of 2022

— form 860.00 - declaration on payment for the use of surface water resources for the 3rd quarter of 2022

— form 870.00 – declaration on payment for emissions into the environment for the 3rd quarter of 2022

November 21

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for October 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

November 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Value Added Tax (VAT)

— Rent tax on export

— Mineral extraction tax

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Gambling business tax

— Payment for placement of outdoor (visual) advertising

— Current payment of fees for emissions into the environment

— Payment for the use of surface water resources

— Retail tax under the special tax regime

5th of December

Payments:

— IPN of a person engaged in private practice

December 15

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for October 2022

December 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for November 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

December 26

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

— Payment for the use of radio frequency spectra

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

Dec. 31

Tax reporting:

— form 101.02 — deadline for additional calculation of advance payments on CIT

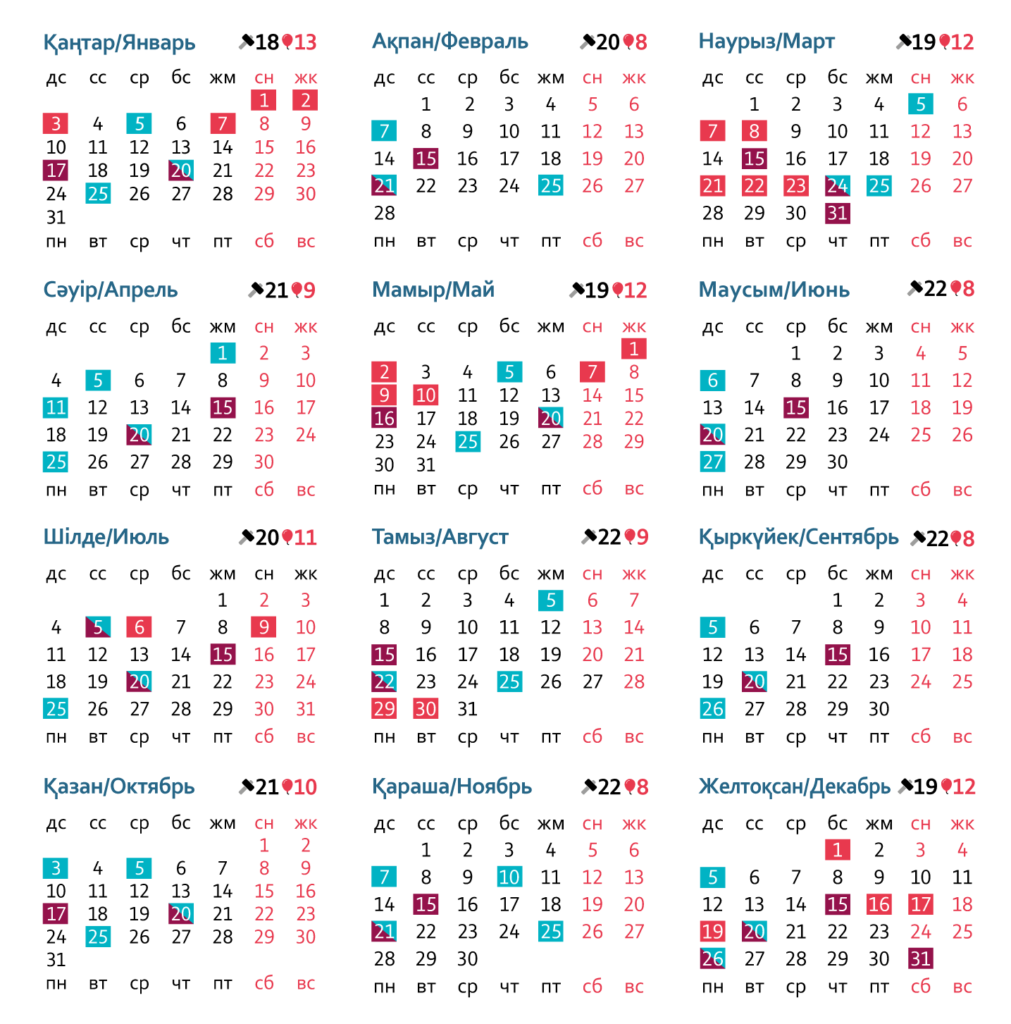

Tax reporting dates and payments to the budget in 2022

5 January

Payments:

— IPN of a person engaged in private practice

January 17

Tax reporting:

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for November 2021

January 20th

Tax reporting:

— form 101.01 – calculation of the amounts of advance payments for CIT before the submission of the CIT declaration for the 1st quarter of 2022

— form 320.00 – declaration on indirect taxes on imported goods + statement on the importation of goods and payment of indirect taxes on form 328.00 for December 2021

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

The 25th of January

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Payment for placement of outdoor (visual) advertising

— CIT at the source of payments

February 7

Payments:

— IPN of a person engaged in private practice

February, 15

Tax reporting:

— form 101.03 — calculation of CIT at the source of payments for the 4th quarter of 2021

— form 200.00 – PIT and social tax declaration for the 4th quarter of 2021

— form 300.00 – VAT return for the 4th quarter of 2021

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for December 2021

— form 570.00 – export tax return for the 4th quarter of 2021

— form 590.00 – mineral extraction tax return for the 4th quarter of 2021

— form 701.01 – calculation of current payments for land tax and property tax for 2022

— Form 710.00 – Gambling tax return and flat tax for the 4th quarter of 2021

— form 860.00 - declaration on payment for the use of surface water resources for the 4th quarter of 2021

— form 870.00 – declaration on payment for emissions into the environment for the 4th quarter of 2021

— form 910.00 – simplified declaration for the 2nd half of 2021

February 21

Tax reporting:

— form 851.00 – calculation of current payments for the use of land plots for 2022

— form 320.00 - declaration on indirect taxes on imported goods + statement on the importation of goods and payment of indirect taxes on the form 328.00 for January 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

25 February

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Rent tax on export

— Mineral extraction tax

— Payment for the use of surface water resources

— CIT at the source of payments

— Value Added Tax (VAT)

— Taxes and payments under the simplified declaration for the 2nd half of 2021

— Payment for placement of outdoor (visual) advertising

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Gambling business tax

— Current payment for emissions into the environment

the 5th of March

Payments:

— IPN of a person engaged in private practice

March 15th

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for January 2022

March 24

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for February 2022

— form 870.00 – declaration on payment for emissions into the environment up to 100 MCI for 2021

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

— Redemption of the limit on payment for emissions into the environment up to 100 MCI

March, 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Payment for the use of radio frequency spectra

— Payment for placement of outdoor (visual) advertising

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

— CIT at the source of payments

March 31

Tax reporting:

— form 100.00, 110.00, 150.00, 180.00 – CIT declaration for 2021

— form 101.04 — calculation of CIT at the source of payments on accrued but unpaid amounts of income of a non-resident for the 4th quarter of 2021

— form 220.00, 240.00 – tax return for 2021

— form 540.00 – excess profit tax return for 2021

— form 700.00 – declaration for land tax, property tax and vehicle tax for 2021

— form 871.00 - register of lease (use) agreements

— Form 912.00 - Declaration under the special tax regime with a fixed deduction for 2021

— form 920.

April 1

Payments:

— Payment of tax on vehicles of individuals for 2021

April 5

Payments:

— IPN of a person engaged in private practice

April 11

Payments:

— Final settlement of IIT / CIT, land tax, property tax, vehicle tax according to the declaration for 2021

— Unified land tax for the period from October 1 to December 31, 2021

— Taxes under the special tax regime with the use of a fixed deduction

— CIT at the source of payments on accrued but unpaid amounts of income of a non-resident for the 4th quarter of 2021

— Tax on excess profits

April 15

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for February 2022

20 April

Tax reporting:

— form 101.02 – calculation of the amounts of advance payments for CIT after the submission of the declaration for the 2-4 quarter of 2022

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for March 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

25th of April

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

5 May

Payments:

— IPN of a person engaged in private practice

16th of May

Tax reporting:

— form 101.03, 101.04 — calculation of CIT at the source of payments for the 1st quarter of 2022

— form 200.00 – PIT and social tax declaration for the 1st quarter of 2022

— form 300.00 – VAT return for the 1st quarter of 2022

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for March 2022

— form 570.00 – export tax return for the 1st quarter of 2022

— form 590.00 – mineral extraction tax return for the 1st quarter of 2022

— form 710.00 – gambling tax return and flat tax for the 1st quarter of 2022

— form 860.00 - declaration on payment for the use of surface water resources for the 1st quarter of 2022

— form 870.00 – declaration on payment for emissions into the environment for the 1st quarter of 2022

May 20

Tax reporting:

— form 320.00 - declaration of indirect taxes on imported goods + application for the importation of goods and payment of indirect taxes on form 328.00 for April 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

May 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Value Added Tax (VAT)

— Rent tax on export

— Mineral extraction tax

— Payment for the use of surface water resources

— Payment for placement of outdoor (visual) advertising

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Current payment of fees for emissions into the environment

— Gambling business tax

— Retail tax under the special tax regime

June 6

Payments:

— IPN of a person engaged in private practice

June 15

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for April 2022

June 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + application for the importation of goods and payment of indirect taxes on form 328.00 for May 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

27th of June

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

— Payment for the use of radio frequency spectra

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

5'th of July

Tax reporting:

— form 701.00 – calculation of current vehicle tax payments for 2022

Payments

— IPN of a person engaged in private practice

— Current vehicle tax payment

July 15

Tax reporting:

— form 250.00 - declaration of assets and liabilities on paper

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for May 2022

July 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for June 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

July 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

5th of August

Payments:

— IPN of a person engaged in private practice

August 15

Tax reporting:

— form 101.03, 101.04 — calculation of CIT at the source of payments for the 2nd quarter of 2022

— form 200.00 – PIT and social tax declaration for the 2nd quarter of 2022

— form 300.00 – VAT return for the 2nd quarter of 2022

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for June 2022

— form 570.00 – export tax return for the 2nd quarter of 2022

— form 590.00 – mineral extraction tax return for the 2nd quarter of 2022

— form 710.00 – gambling tax return and flat tax for the 2nd quarter of 2022

— form 860.00 - declaration on payment for the use of surface water resources for the 2nd quarter of 2022

— form 870.00 – declaration on payment for emissions into the environment for the 2nd quarter of 2022

— form 910.00 - simplified declaration for the 1st half of 2022

August 22

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for July 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

25-th of August

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— Taxes on a simplified declaration for the 1st half of 2022

— Value Added Tax (VAT)

— CIT at the source of payments

— Mineral extraction tax

— Rent tax on export

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Payment for placement of outdoor (visual) advertising

— Payment for the use of surface water resources

— Current payment of fees for emissions into the environment

— Gambling business tax

— Retail tax under the special tax regime

September 5

Payments:

— IPN of a person engaged in private practice

September 15th

Tax reporting:

— form 250.00 - declaration of assets and liabilities on paper

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for July 2022

September 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for August 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

September 26

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

— Payment for the use of radio frequency spectra

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

October 3

Payments:

— Payment of the combined tax on the property of individuals

October 5

Payments:

— IPN of a person engaged in private practice

17 October

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for August st 2022

The 20th of October

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for September 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

the 25th of October

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

November 7

Payments:

— IPN of a person engaged in private practice

10th of November

Payments:

— Payment of the unified land tax for the period from January 1 to October 1, 2022

15th of November

Tax reporting:

— form 101.03, 101.04 — calculation of CIT at the source of payments for the 3rd quarter of 2022

— form 200.00 – PIT and social tax declaration for the 3rd quarter of 2022

— form 300.00 – VAT return for the 3rd quarter of 2022

— form 400.00 – excise declaration + calculation for structural divisions in form 421.00 for September 2022

— form 570.00 – export tax return for the 3rd quarter of 2022

— form 590.00 – mineral extraction tax return for the 3rd quarter of 2022

— form 710.00 – gambling tax return and flat tax for the 3rd quarter of 2022

— form 860.00 - declaration on payment for the use of surface water resources for the 3rd quarter of 2022

— form 870.00 – declaration on payment for emissions into the environment for the 3rd quarter of 2022

November 21

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for October 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

November 25

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— Advance payments on CIT

— CIT at the source of payments

— Value Added Tax (VAT)

— Rent tax on export

— Mineral extraction tax

— Current payment of land tax and property tax

— Current payment on payment for the use of land plots

— Gambling business tax

— Payment for placement of outdoor (visual) advertising

— Current payment of fees for emissions into the environment

— Payment for the use of surface water resources

— Retail tax under the special tax regime

5th of December

Payments:

— IPN of a person engaged in private practice

December 15

Tax reporting:

— form 400.00 – excise declaration + calculation for structural units in form 421.00 for October 2022

December 20

Tax reporting:

— form 320.00 - declaration on indirect taxes on imported goods + statement on the import of goods and payment of indirect taxes on form 328.00 for November 2022

Payments:

— Excise + excise for structural divisions

— Amounts of indirect taxes on imported goods within the EAEU

December 26

Payments:

— PIT at the source of payments, social tax, social contributions, CPC, CPC, deductions for OSMS, CPC under GPC agreements

— CIT at the source of payments

— Payment for placement of outdoor (visual) advertising

— Payment for the use of radio frequency spectra

— Payment for the provision of long-distance and (or) international telephone communications, as well as cellular communications

— Payment for the use of licenses to engage in certain types of activities

Dec. 31

Tax reporting:

— form 101.02 — deadline for additional calculation of advance payments on CIT